More than half, 56% of primary grocery shoppers, were extremely concerned about COVID-19 this week, according to the IRI survey of primary grocery shoppers. This is the highest rate on the question since the first week of May. Additionally, more than one-third of Americans said they were more concerned than they were last week, especially shoppers residing in California (49%), Texas (46%) and Florida (42%). This heightened concern is translating into more of the total food demand flowing to retail than seen during some of the non-holiday weeks in May and June. Additionally, many shoppers are dealing with financial pressure. In IRI’s survey this past week, 30% of primary grocery shoppers say their financial situation is a little or a lot worse off than it was a year ago.

All this resulted in continued highly elevated demand for meat at retail. Meat department dollar sales increased 22.2% versus year ago — about one percentage point less than last week’s 23.4% and the 20th week of double-digit gains since the onset of the pandemic. Whereas dollar sales were slightly lower than the week prior, volume sales increased as prices became more favorable for consumers. Volume sales increased 11.0%, the second week of double digit volume gains in July. Unit sales continue to wow as well, with 21.2 million more transactions compared with same week year ago and 842 million more transactions since the pandemic began. Pre-pandemic, total meat dept units were down versus year ago.

So far during the pandemic, starting March 15 through July 26, dollar sales are up 34.6% and volume sales have increased 21.4% versus the same period last year. This translates into an additional $7.9 billion in meat department sales during the pandemic, which includes an additional $3.6 billion for beef, $1.1 billion for chicken and $838 million for pork.

Dollar versus Volume Gains

The total meat volume/dollar gap narrowed to 11.2 points, from 13.4 points the week prior. Fresh meat had a slightly stronger week than processed meat in dollars, but processed had higher volume gains. The volume/dollar gap is 2.6 points wider for fresh than processed.

| Latest 1 week ending July 26, 2020 versus comparable week in 2019 | Dollar gains | Volume gains |

Volume/dollar gap (percentage points) |

| Total meat | +22.2% | +11.0% | -11.2 |

| Total fresh | +22.4% | +10.7% | -11.7 |

| Total processed | +21.5% | +12.4% | -9.1 |

Source: IRI, Total US, MULO, 1 week % gain versus YA

The longer, four-week look ending July 26 shows a 13.0 point gap between volume and dollars versus 11.2 points for the latest one week — signaling prices continue to come down. The longer view shows double digit gaps for beef and lamb, but pork has narrowed to just 8.9 points, the same as chicken. Fresh exotic meats, including bison, is the only area that sees volume gains trending slightly ahead of dollar gains with very steady pricing throughout the pandemic.

| Latest 4 weeks ending July 26, 2020 versus comparable weeks in 2019 | Dollar gains | Volume gains |

Volume/dollar gap (percentage points) |

| Total meat | +21.1% | +8.1% | -13.0 |

| Fresh beef | +27.5% | +10.5% | -17.0 |

| Ground beef | +22.1% | +5.5% | -16.6 |

| Fresh chicken | +12.0% | +3.1% | -8.9 |

| Fresh pork | +20.6% | +11.7% | -8.9 |

| Fresh turkey | +16.8% | +13.2% | -3.6 |

| Fresh lamb | +39.2% | +28.0% | -11.2 |

| Fresh exotic | +36.3% | +36.9% | +0.6 |

| Fresh veal | +17.0% | +13.4% | -3.6 |

| Smoked ham/pork | +25.9% | +24.6% | -1.3 |

| Sausage | +17.3% | +10.1% | -7.2 |

| Frankfurters | +14.2% | -1.9% | -16.1 |

| Bacon | +19.4% | +11.9% | -7.5 |

Source: IRI, Total US, MULO, 4 weeks ending July 26, 2020 versus YA

Assortment

The number of items continued to rebound as production issues have largely been resolved. Dipping well below 300 during the height of the supply chain woes, assortment was back at an average of 319 items per store during the week ending July 26. With non-holiday weeks typically offering fewer items, this average is down about 20 from prior year levels. Having the right selection of items remains crucial to shopper satisfaction, as evidenced by the continued shopper comments in this area on the Retail Feedback Group’s Constant Customer Feedback (CCF) system. One shopper wrote in, “I know this is a difficult time for meats and many other things. It seems coronavirus has crippled selections of meats especially. I normally buy prime cuts of beef, like filets and porterhouse cuts and thick cut pork chops. The store always carried them before but they have been absent lately. I'm sure you will when all of this is over. Hope we can all return to normal soon.” Others commented on out-of-stocks, “There was very limited variety of chicken and pork to choose from. Please offer meat packages in smaller portions (i.e. serving one or two). Only had the choice of large packs of chicken breasts and tenderloins.”

| Average weekly items per store selling for week ending… | |||||||||

| 3/1 | 3/8 | 3/15 | 3/22 | 3/29 | April (4/5-4/26) | May (5/3-5/31) | June (6/7-6/28) | 7/19 | 7/26 |

| 335 | 334 | 353 | 330 | 308 | 315 | 301 | 304 | 317 | 319 |

Source: IRI, Total US, MULO, average weekly items per store selling

Price

Price-related comments also continue to come in on CCF. One shopper wrote, “Prices are steep during the pandemic. $10 for four raw burgers when I can get four cooked ones with buns at McDonald’s for less.” Another shopper noted, “Your prices have escalated at a higher rate than the cost of living while the selection in your store has decreased. Not a good combination.”

And while prices are indeed still elevated versus year ago, IRI’s pricing insights shows the situation is improving every week. When comparing the average price per volume for the total meat department during the week of July 26 to the same week in 2019, prices were up 10.1%. The average of $3.89, however, is down 1.6% from the week prior, with significant decreases for ground beef and pork. The slightly longer four week look shows that prices are still coming down. The four week period ending July 26 shows prices up +12.1% versus the same four week period in 2019, versus 10.1% in the one-week look.

|

Average price per volume versus the same period year ago |

1 week ending July 26 | 4 weeks ending July 26 | |||

| Average | Change vs. prior period |

Change vs. YA |

Average | Change vs. year ago | |

| Total meat | $3.89 | -1.6% | +10.1% | $3.94 | +12.1% |

| Fresh beef | $5.63 | -1.1% | +13.6% | $5.69 | +15.3% |

| Ground beef | $4.24 | -3.7% | +11.0% | $4.36 | +15.7% |

| Fresh chicken | $2.49 | +0.5% | +7.8% | $2.48 | +8.6% |

| Fresh pork | $2.80 | -5.2% | +3.3% | $2.89 | +8.0% |

| Fresh turkey | $3.40 | +0.4% | +1.4% | $3.41 | +3.2% |

| Fresh lamb | $8.69 | +2.1% | +13.3% | $8.49 | +8.8% |

| Fresh exotic | $4.15 | -3.9% | -5.2% | $4.38 | -0.5% |

Source: IRI, Total US, MULO, 1 week and 4 weeks ending July 26, 2020

Meat Gains by Protein

The overall 22.2% meat department gain was fueled by double-digit gains for all proteins. Lamb and beef had the highest percentage growth, at +49.5% and +26.8%. Beef easily had the highest absolute dollar gains (+$115 million), followed by chicken (+$31 million) and pork (+$23 million). The past week included the Eid al-Adha holiday in the Muslim faith, potentially contributing to the bump in lamb sales.

Grinds

Ground beef reached its highest volume gains since mid April, at +8.4% as prices are becoming more favorable to the consumer. The other grinds, turkey, chicken and pork, were still in double digits for both dollars and volume, but gains were not as high as those seen during the peak of ground beef prices. For the week ending July 19 versus year ago, these four ground proteins generated $241 million in sales, which represents an additional $40 million versus year ago. Ground beef represents 87.1% of sales but 88.9% of additional dollars.

- Ground beef increased 20.2% in dollars and saw its largest increase in volume since mid April, at +8.4%.

- Ground turkey, +14.9% in dollars and +13.1% in volume.

- Ground chicken, +23.3% in dollars and +20.5% in volume

- Ground pork, +21.4% in dollars and +22.3% in volume.

The Pandemic Sales Performance by Area

Meat department sales were $1.3 billion during the week of July 26. Beef represented a big share, at $545 million, with a massive gain of 26.8%. All areas gained double digits versus the same week year ago, with the highest gain generated by lamb, though off a small base and the lowest gain by fresh chicken, at 14.0%.

| 2020 Weekly $ sales gains versus comparable 2019 week ending… | $ | |||||||

| 3/1 |

March (3/8-3/29) |

April (4/5-4/26) |

May (5/3-5/31) | June (6/7-6/28) | 7/19 | 7/26 | 7/26 | |

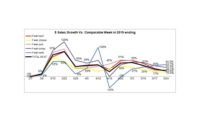

| TOTAL MEAT | -1% | +54% | +38% | +32% | +22% | +23.4% | +22.2% | $1.3B |

| Fresh | ||||||||

| Beef | 0% | +53% | +42% | +36% | +27% | +30.4% | +26.8% | $545M |

| Chicken | +1% | +41% | +32% | +21% | +13% | +14.2% | +14.0% | $253M |

| Pork | -5% | +56% | +44% | +32% | +24% | +17.1% | +21.2% | $132M |

| Turkey | 0% | +72% | +36% | +43% | +23% | +18.8% | +17.1% | $37M |

| Lamb | +1% | +34% | +8% | +36% | +39% | +40.5% | +49.5% | $9M |

| Exotic | +5% | +92% | +54% | +61% | +48% | +38.9% | +35.7% | $3M |

| Processed | ||||||||

| Smoked ham/pork | -6% | +118% | +20% | +63% | +35% | +29.2% | +25.1% | $15M |

| Sausage | 0% | +63% | +42% | +35% | +24% | +21.8% | +21.3% | $121M |

| Frankfurters | -1% | +76% | +39% | +20% | +17% | +16.9% | +19.5% | $61M |

| Bacon | -6% | +54% | +48% | +34% | +18% | +23.1% | +22.2% | $115M |

Source: IRI, Total US, MULO, 1 week % change vs. YA

Market Shifts

The pandemic market share trends remained unchanged the last full week of July. Pork and beef had a higher dollar and volume share than pre-pandemic. Pork, in particular, has seen an uptick in volume share, from 16.5% during the first week of March to 18.3% late July. Exotic meats, which includes bison, are the third protein with dollar gains. Chicken remained down in both dollar and volume share.

| Share of dollar sales | Share of volume sales | |||||

| Week ending 3/1 | Week ending 7/26 | Building calendar year 2019 | Building calendar year 2020 |

Week ending 3/1 |

Week ending 7/26 |

|

| Beef | 53.3% | 55.6% | 54.2% | 55.5% | 37.0% | 37.4% |

| Chicken | 27.5% | 25.8% | 26.7% | 25.3% | 40.5% | 39.4% |

| Pork | 12.9% | 13.5% | 13.6% | 13.6% | 16.5% | 18.3% |

| Turkey | 4.4% | 3.8% | 4.2% | 4.3% | 4.8% | 4.2% |

| Lamb | 0.9% | 1.0% | 0.9% | 0.9% | 0.4% | 0.4% |

| Veal | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | <0.1% |

| Exotic | 0.3% | 0.3% | 0.3% | 0.3% | 0.2% | 0.3% |

Source: IRI, Total US, MULO, % of total meat department dollars | “All other” not reflected

What’s Next?

As concern is rising again, more Americans plan to further delay their return to normal activities, according to the IRI shopper survey — though in part this may be due to state mandates disabling them to engage in these activities. Up from 56% two weeks prior, 73% of consumers will wait at least four more weeks before going to a bar/club; 56% will wait this amount of time before dining out at a restaurant and 45% before going to a coffee shop — signaling delayed engagement with foodservice.

Meanwhile, several of the early pandemic purchasing patterns are reemerging, including stocking up on food. Two-thirds of shoppers (66%) aim to buy enough food for their households to last them two to four weeks, according to the IRI survey. As such, items with longer shelf life continue to do well, which favors frozen meat and seafood sales and fresh items in packaging that ensures longer shelf life.

Back-to-school season is also still up in the air. In the IRI shopper survey, a third of parents said they do not know yet if and when their children will be in school in the fall. Fewer than one in five expect to have their child/children back at the school for a full schedule as of the late July survey. Almost half of parents who usually have a daycare/childcare provider for a child under six continue to say they will wait at least four more weeks to resume care.

Between the renewed social distancing mandates, rising consumer concern about the virus and economic pressure, grocery sales are likely to remain highly elevated for the foreseeable future.

Source: 210 Analytics/IRI

Report Abusive Comment