While fresh bread is the largest category in the bakery industry, it has remained relatively flat for the past several years. But several emerging trends have fostered growth, pointing the way toward future potential for the category.

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products

Market data

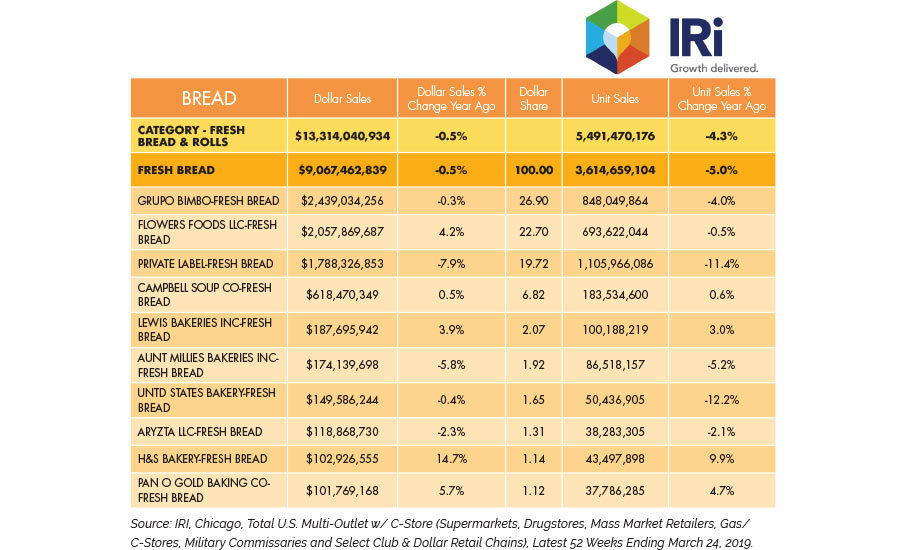

For the 52 weeks ending March 24, 2019, per IRI, Chicago, the fresh bread segment dropped 0.5 percent to $9.1 billion. A notable sales increase came from Flowers Foods, which was up 4.2 percent to $2.1 billion, and Flowers has reported that its organic Dave’s Killer Bread brand was partially responsible for this growth. Other gainers include Lewis Bakeries, up 3.9 percent to $189.7 million. Lewis has seen success with a wider distribution of its half loaf bread products. H&S Bakery also saw strong growth, up 14.7 percent to $102.9 million.

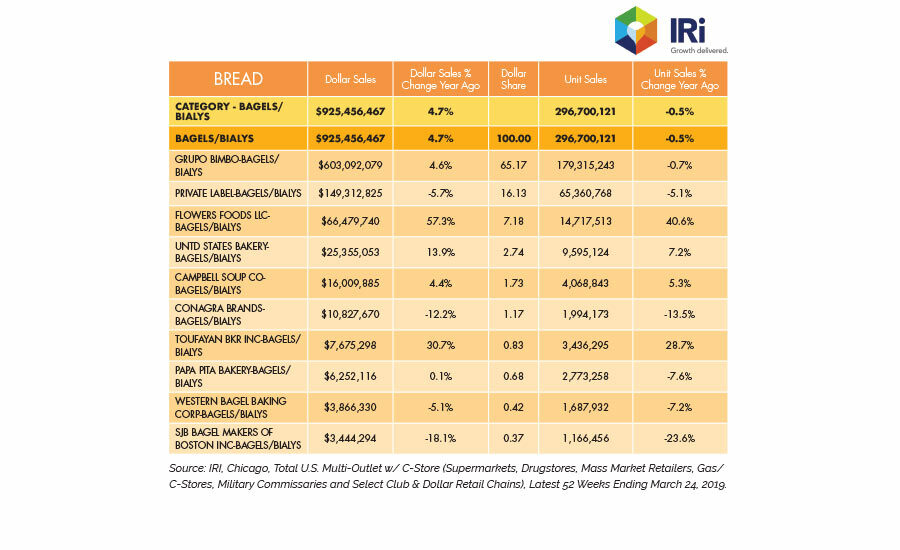

The bagels/bialys category grew 4.7 percent for the year, climbing to $925.5 million. Category leader Grupo Bimbo and its flagship bagel brand Thomas’ saw an increase of 4.6 percent to $603.1 million. Flowers Foods, which has extended its organic Dave’s Killer Bread brand into the bagels category, saw significant growth of 57.3 percent to $66.5 million. Toufayan Bakery also had a good year in bagels, up 30.7 percent to $7.7 million. Toufayan’s Smart Bagel line is slightly thinner than a typical bagel, catering to better-for-you shoppers.

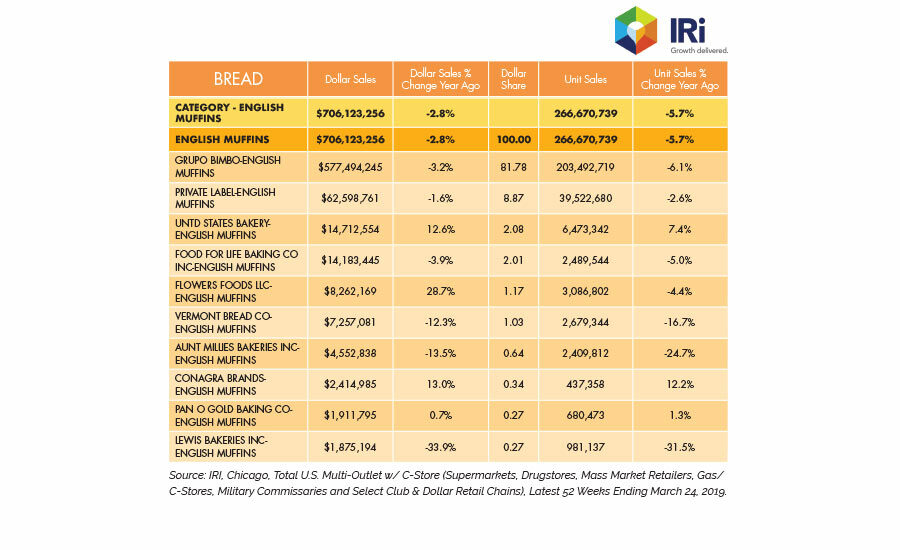

English muffins had a slightly off year, down 2.8 percent to $706.1 million. But select bakeries saw increases, with United States Bakery up 12.6 percent to $14.7 million, Flowers Foods up 28.7 percent to $8.3 million, and Conagra Brands up 13.0 percent to $2.4 million.

Looking back

“This past year really gave rise to bread’s resurgence,” says Jonathan Davis, senior vice president of innovation, La Brea Bakery, Los Angeles. “With research around the health benefits of sourdough bread and the popularity of whole grains, we saw consumers appreciate bread once again and become more open-minded when it came to wholesome, nutritious varieties. Bakeries have also recognized consumer demand for smaller portion sizes, so smaller loaves, rounds and demi-baguettes have been trending now more than ever before.”

Davis notes that this was, in large part, the catalyst for the launch of the La Brea Bakery Reserve Demi-Baguettes. “By using traceable ingredients and incorporating our signature sourdough starter in a smaller baguette, these breads in particular resonated with our customer base.”

Organic pan breads are among the most-popular varieties in North America as millennials and Generation Z opt for cleaner, healthier options, says Cam Suarez-Bitar, marketing and public relations manager, Bellarise, Pasadena, CA. He notes that Bellarise organic softeners and dough conditioners can help bakers get the right texture, crust color, flavor, crumb structure in organic breads.

Organic and artisanal breads have been trending in the bread aisles, says Norm Ross, technical service representative, Bay State Milling Co., Mooresville, NC. “Sprouted grains continue to gain traction as consumers look for products that offer greater nutrition and have a healthy halo. Sprouted whole grains carry a sweeter flavor profile over conventional whole wheat. This allows bakers to dial back sweeteners in their formulas, which is attractive to consumers who are looking to curb calorie and sugar intake.”

Consumers are looking for heathier choices—including breads made with toppings such as seeds and whole grains, says Clint Adams, AMF Tromp product sales specialist, AMF Bakery Systems, Richmond, VA. “Also, any inclusions, such as fruits, that can be perceived as healthy are growing in demand.”

Looking forward

“We see continued growth in a greater variety of value-added breads,” says Adams. “Bakers are looking to differentiate their products to increase sales and profit margins. Higher-quality, European-style breads will continue to shape the industry. These breads require longer resting times, less stress on the dough during processing, and—a lot of the time—will have toppings.”

Adams notes that AMF Bakery Systems is preparing for these changes by incorporating AMF Tromp sheeting lines alongside the more-traditional extrusion or volumetric makeup lines within the bakery.

Adams also recommends that bakers build flexibility into the design of any new lines to accommodate potential new product introductions. “Unique, value-added products will continue to shape the industry. They will then become the norm, and bakers will scale-up those production lines.” So building in that potential from the start is a smart move.

“Bakers will then need to increase focus on controlling and reducing the costs of these expensive ingredients,” says Adams, suggesting that bakers look for targeted solutions to reduce waste. For example, he notes, if using an expensive seed or nut as a topping on a round bread, the AMF Tromp traveling Target Seeder may be an option to deposit it in a round pattern so the toppings are not wasted on the pan or the floor.

People are gravitating toward healthier bread choices, and this pattern will likely continue. Ross notes that high-fiber breads are going strong, along with multigrain and seeded breads.

“Artisan-style breads featuring inclusions, high fiber content and ancient grains make up a strong trend that should continue to grow through the foreseeable future,” says Suarez-Bitar. He notes that younger generations, in particular, demand delicious, authentic breads with a simple, clean ingredient list.

“Clean label has been a buzzword for several years now, and I don’t see this trend slowing down anytime soon,” says Davis. “Consumers are looking to buy free-from foods, especially when it comes to bread, whether it’s gluten-free or non-GMO. While it’s by no means easy for bakeries to reformulate their ingredients to meet the broad definition of clean label, it makes a huge difference for the consumer.”

When going clean-label, every ingredient requires scrutiny, and sometimes a multifunctional ingredient like malt grows more attractive. Ken Skrzypiec, vice president, eastern sales, Brolite Products, Bartlett, IL, suggests using Brolite’s Dark Malt to replace caramel color in whole-grain, rye and pumpernickel breads.

These nutrition-forward breads gaining popularity often require special considerations. “Formula optimization and proper hydration is key when baking with whole grains,” says Ross. “Keep the formula clean-label and reduce sugar by using sprouted grains for a naturally sweeter flavor profile. If you’re adding particulates in excess of 5 to 7 percent, add them toward the end of the mix cycle to preserve the gluten structure. Run a hydration series to maximize your absorption. Oftentimes, weakness in oven spring occurs from lack of hydration and improper mix times due to short mixes.”

Suarez-Bitar suggests clean-label, plant-based ingredients could make bread products more appealing to vegan consumers, an increasingly popular dietary choice. He points to data showing that the number of vegans in the U.S. increased by 600 percent from 2014 to 2017.

That makes plant protein a strong choice for new bread products. Skrzypiec taps protein-enriched and probiotic breads as trends to watch. “The proliferation of plant-based proteins are starting to make their way into other items and will start to trickle into the bread aisle. These can be sold as premium products.” By introducing probiotics to breads, he suggests, bakers might be able to bring consumers who are concerned about their gut health back to the bread aisle.

“Gluten-free products will also continue to grow in demand, especially as more bakers roll out products that are easy to eat and have similar taste profiles and texture compared to traditional breads,” says Adams.

It took the team at La Brea Bakery years to create the right formula for its gluten-free breads, notes Davis—and even longer when they embarked on removing GMOs from nearly all La Brea Bakery breads. “While it was a process to become Non-GMO Project Verified, the payoff has been huge in the positive reception we’ve gotten from our grocery partners and consumers.”

Suarez-Bitar suggests that ethnic options also show strong potential. “We are seeing Latin, Hispanic, Indian, African and Asian breads catching on with a North American market hungry for new, healthy, convenient and delicious breads that can be enjoyed at any time.” He recommends the Bellarise Clean Label Brioche Improver and Brioche Base for bakeries looking to offer a broad range of French and Hispanic breads that leverage several key market trends.

Added sugar should also be top-of-mind for bakers in the coming year. “With new sugar labeling regulations coming into effect in 2020, bakeries producing sweeter pan breads have an excellent opportunity to limit sugar content while enhancing their breads’ essential properties, including flavor profile and texture,” says Suarez-Bitar.

Other labeling measures are likewise afoot, with bioengineered foods disclosure mandated on the label by 2020 (small bakeries get until 2021). “With the FDA recently publishing its standards for non-GMO—an increasingly important component of North American bread consumers’ decision-making process—it will be interesting to see how consumers respond to new labeling, and how commercial and industrial bakeries tell their non-GMO story,” says Suarez-Bitar. He suggests that enzyme-based solutions present bakeries of all sizes with the best and easiest ways of going organic and non-GMO.

“Incorporating new ingredients makes all the difference, especially when it comes to bakeries that have been around for years,” says Davis. “La Brea Bakery recently celebrated its 30th anniversary, and to commemorate the occasion, we decided to launch an entirely new portfolio of breads that we knew our customers wanted.”

Davis notes that he worked with Nancy Silverton, the founder of La Brea Bakery, to develop the new La Brea Bakery Founders breads. “In this line, we used ingredients like whole grains, sprouted grains, seeds and alternative flours. In the end, we created three new loaves: Pain Levain, Sprouted Multigrain & Seed, and Country Wheat Batard. Extensive research into consumer trends shifting to embrace these kinds of ingredients, like whole grains, gave us the inspiration for this new portfolio, and we are really looking forward to the reception of these new breads when they hit shelves this fall.”

Overview | Bread | Tortillas | Sweet Goods | Snack Cakes | Pizza | Desserts | Cookies | Buns & Rolls | Bars | Breakfast Products