Transportation has evolved tremendously over the last century. From horse and buggy to steam power, the internal combustion engine, multi-speed powertrains, and the latest push for hybrids and electrification—the way things move has changed tremendously. Not only have power systems evolved, so too have the construction and finishes of vehicles, including steel body enclosures and the addition of windscreens, plush interiors, and electronic systems.

Adhesives have also evolved over the last 100-plus years, in both formulations and applications in vehicle assembly. Advanced sealants and adhesives in vehicle assembly effectively and safely address key applications that have traditionally employed mechanical fasteners (e.g., rivets, welds, screws, and clinches) while adding design freedom to today’s modern vehicles.

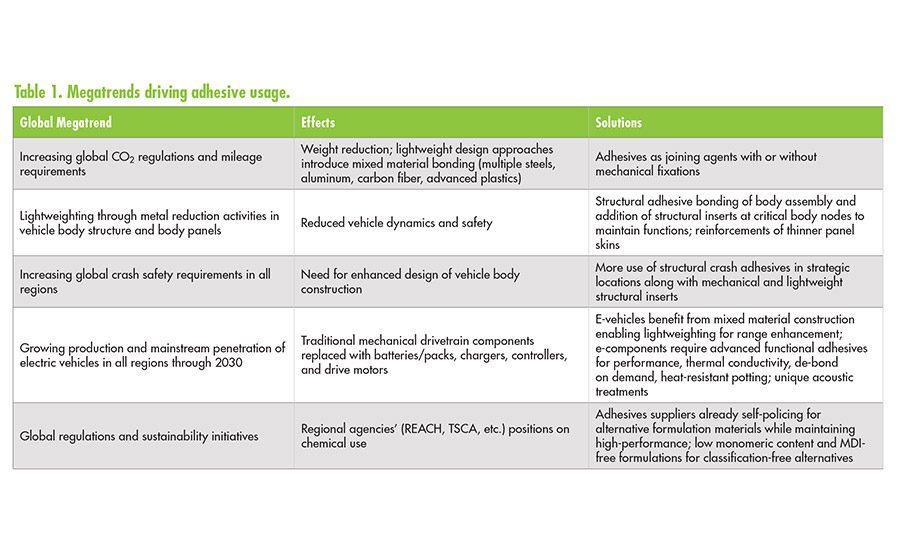

The use of adhesives is by no means new, but their growing use enables design trends that even 10 years ago were improbable. Driving the growth of adhesive use are global megatrends in the ever-changing world of assembling vehicles (see Table 1).

As illustrated in Figure 1, it is quite easy to see that occupants in today’s advanced vehicles are surrounded by adhesives. And while they are never seen, adhesives are critical to vehicle performance, aesthetics, and comfort.

For adhesive suppliers and users, the selection of products and chemistries is based on multiple factors, including the materials to be joined, joint design assembly method (automated or manual, room temperature or heated dispense), and curing process (heated or cold curing). Further, the performance requirements of the adhesive/substrate interface (i.e., the joint) must be determined. Is the function bonding or sealing, rigid or flexible, crash or non-crash, or general assembly? Performance requirements must also be accounted for, whether the adhesive is located in the body structural assembly or in visible panels and hang-on parts where class A surfaces exist that cannot exhibit bond line read through (BLRT).

Today’s world of mixed materials brings additional considerations with regard to delta/alpha (D/a). Different materials expand and contract at different rates (e.g., aluminum, steel, or carbon fiber). Adhesives can and do play a crucial role in compensating for materials’ different expansion coefficients and, in effect, can serve as the interface allowing for these differentials. Figure 2 shows a basic breakdown illustrating chemistries and performance parameters with overlaps depending on performance requirements.

Adhesive chemistries include epoxies, polyurethanes, methylmethacrylates, rubber-based anti-flutters, PVC, butyls, bitumens, thermoplastics, and in-component manufacturing silicones. Products are chemically cured (i.e., two-component A/B with a base and an activator base), “boosted” to ensure faster rates of cure (polyurethanes), or cured solely by heat or moisture condensation. Adhesives are also rated with modulus-hardness and elongation-flexibility.

Adhesive applications can be organized by the areas where the majority of assembly operations are performed: body shop, paint shop, and trim shop. In addition, multiple sub-assemblies from component suppliers add in at various stations in the process.

In the Body Shop

Widely used in vehicle body shop (body in white, or BIW) assembly applications—and regularly applied in concert with mechanical fixation—hot-cured epoxy technologies are the product of choice. This also holds true for the hang-on parts such as doors, hoods, and liftgates. A variety of product performance ranges are available that are specific to the required applications of sealing, semi-structural, structural, or crash. Products are specification driven, and OEMs typically have similar but slightly differing requirements.

In addition, rubber-based anti-flutter adhesives bond the larger panels such as roof bows to roof skins and hoods to frames while providing firm but flexible joining to eliminate vibration. BIW adhesives must be corrosion tested and qualified for applications through rigorous tests and test methods, including crash testing.

Adhesives also function to prevent galvanic corrosion between dissimilar substrates. Application is done at component suppliers for hang-on parts and in the production line for BIW completion. Epoxy and rubber-based products cure in the bake ovens following assembly and e-coat.

Adhesives also add physical and audible comfort to interiors by improving vehicle dynamics and managing acoustic performance behind the scenes. Structural adhesives stiffen the body structure by joining the various components of the BIW. Additional opportunities to add stiffness and safety are available through the selective use of lightweight geometric structural reinforcements as alternatives to heavier metal reinforcement.

Injection-molded fiber reinforced plastic (FRP) inserts designed to the contours of cavity placement can be secured either by pre-molded epoxy coatings or body shop adhesives for even higher performance. As mass is removed, structural inserts compensate for the differentials. The inserts are placed strategically through modeling performance and are added to strategic nodes to add rigidity and improve NVH and/or crash performance where required. Typical crash applications include frontal crash, side crash, or roof crush to prevent impact intrusion to the passenger compartment. This technology approach allows for lightweighting efforts to be achieved while maintaining or even enhancing structural integrity and vehicle dynamics.

To further address comfort, highly engineered “baffle” products—combinations of Nylon and thermoplastic materials provided as engineered parts or extruded tapes—are added to vehicle body cavities during assembly to block airborne noise paths in the pillars of the vehicle, along the beltline, and throughout the sills for watertight applications. The thermoplastic material expands in the bake ovens to seal the cavities. To eliminate structure-borne noise, “adhesives” include applications of constrained layer dampers in butyl and bitumen, bitumen damping patches, melt sheets, or liquid-applied coatings known as LASD. Between baffle and damping, applications can be optimized through full vehicle testing in acoustic labs for highly tuned combinations and optimal efficiencies.

In the Trim Shop

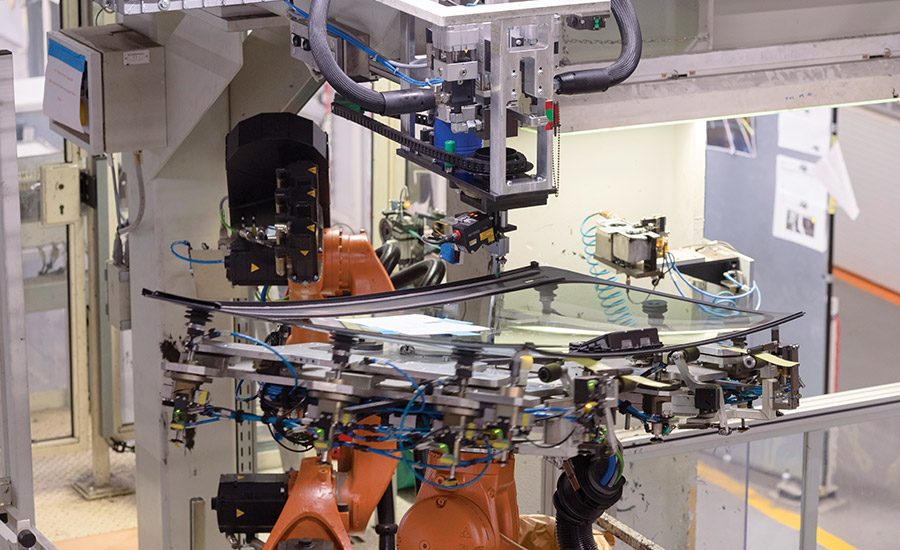

Direct glazing of glass (e.g., windshields, sidelights, and decorative glass) is also accomplished in trim typically using one-component polyurethane-based products. Component assemblies added to the vehicle in the trim shop also benefit from adhesives.

The move toward the use of more and larger glass elements in vehicles such as sunroofs and wide-open panoramic roofs (WOPR), coupled with new combinations of plastics used in their housings, has led to the development of specific chemistries that enable reliable adhesion. These are fed to the line typically as assemblies, but are installed in trim. New high-performing headlamps, tail lamps, spoilers, antennas, and automated sensing door handles also join the vehicle body here, and all benefit from advanced adhesives use, typically at the Tier 1 component manufacturers.

Adhesives also enable the evolution of the visible vehicle interior, enhancing the personal environment while answering the challenges of mixed materials (e.g., PVC, TPO, and ABS to vinyl, plastic, and leather skins), affording high-end possibilities not only for luxury vehicles but also providing plushness to all vehicle levels. Thermoplastic coatings, reactive urethanes, and water-based coating products are used to laminate door skins, armrests, headliners, consoles, load floors, and steering wheels with materials to add the soft touch to the cabin environment. Further, spray adhesives used in flocking applications add the soft surfaces to glove box and console compartments, as well as the various seals seen in typical openings in the vehicle (e.g., doors and liftgates).

Automobiles as Computing Platforms

When we look back several decades, a notable evolution has been the conversion of vehicles to computing platforms with high-performing systems. Accessory systems such as active cruise control, lane departure, back-up cameras, automated park systems, automated braking, traction control, vehicle guidance, infotainment, wireless networking, satellite guidance, and heated accessories such as seats and steering wheels have added more adhesive use to vehicles.

Most prominent in these categories are the variety of system ECUs, controllers, harnesses, sensors, and in-dash and overhead displays. We take these systems for granted, but their performance is enabled through encapsulation, potting, bonding, and sealing processes for long-term durability and performance. Typical chemistries here are two-part polyurethane, epoxies, and two-part silicone chemistries.

Electrification Evolution or Revolution?

The most current megatrend driving automobiles is the electrification of our industry, and only history will decide the correct terminology. While headlines drive the news, the wave of conversion is actively underway. The remaining question is only how consumers will embrace the shift. With electrification, the groundwork is also solidified for the next megatrend.

New vehicles in this class rely on advanced body lightweighting for extended range capability and to compensate for the weight of added componentry. Body structures must accommodate new systems, including batteries, battery packs, electric drive motors, on-board chargers, and a new series of electronics. In addition, while different, the elimination of traditional drivetrain components also simplifies assembly.

Two major paths of thought have emerged with many design approaches: offering traditional vehicle types that offer electric variants including hybrid and full electric versions, or specially designed body architecture specific to the electric-only versions. Further vision in this direction also potentially includes a sled and a top-hat variant that allows multiple vehicle models with a common drivetrain/drive module.

Within all approaches, we can expect that adhesives will remain a primary technology for enabling the migration. Indeed, opportunities exist for expanded adhesive usage, as battery packs require both heating and cooling systems to operate at maximum performance; heat is both an enemy and an ally to peak functionality, depending on the geographic locations of vehicle operation. In addition, added protection will be required for battery packs in case of collision events.

There is no doubt, regardless of the design approaches taken, that functional adhesives provide unique performance characteristics, including faster cure, thermal conductivity, and heat insulation, as well as fire-rated adhesives and coatings and selective reinforcement techniques for battery pack safety. All of these factors will enable the design choices made.

Future Growth

What does the future hold for automotive adhesive usage? Growth. From adhesive manufacturers’ or applicators’ perspectives, considerations continue to be driven by global megatrends and include:

- More value-add approaches for assembly using adhesives in automated applications for reduction/elimination of mechanical fixation and labor costs

- Novel product chemistries combining the benefits of multiple chemistries in use today to new baseline formulations with combined benefits

- Continued and increased use of mixed materials require consideration of joining methods that accommodate unique D/a challenges and the elimination of BLRT on Class A surfaces

- Cure-on-demand technologies, as well as allowance for fast fixation similar to spot welding prior to full cure

- De-bond on demand for serviceability, particularly in electric vehicle componentry where service must be performed

- New approaches to acoustic solutions in electric vehicles due to the absence of traditional engine and transmission noise and new frequencies in noise transmission

- Lower bake temperatures experienced by design where heat does not penetrate metals fully, or through sustainability initiatives by manufacturers (utility savings)

- Continued regulations regarding chemical ingredients/formulations and regional moves toward “odor-free” adhesive products (e.g., Europe and China)

- Enhanced use of modeling adhesive performance in “virtual” analysis to predict performance and failure in conjunction with or prior to prototype build levels

There is no doubt that adhesive chemistries’ use and versatility will continue to flourish in enabling the results of the megatrends that continually change our industry. The global adhesives supplier base is ready to meet the next big design challenges.

For more information, contact the author at (248) 577-1024 or moran.greg@us.sika.com, or visit https://automotive.sika.com.