Federal efforts to counter climate change have received a major boost through a just-enacted $700-billion measure whose centerpiece is a variety of tax incentives and federal funds aimed at reducing greenhouse gas emissions.

President Joe Biden signed the bill, the Inflation Reduction Act, on Aug. 16 in a White House ceremony.

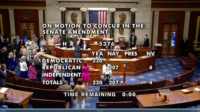

Final congressional approval for the measure came just four days earlier, with House passage on a 220-207, party line vote. The Senate had cleared it on Aug. 7, by 51-50, also on party lines.

In remarks before he signed the measure Biden said it includes $369 billion “to take the most aggressive action ever, ever, ever, ever in confronting the climate crisis and strengthening our energy security.”

Design organizations, such as the American Society of Civil Engineers and American Institute of Architects, cheered the legislation, citing its climate provisions, which affect an array of sectors, including buildings, transportation, renewable energy and carbon capture.

The legislation includes extensions of federal tax credits for solar, wind and other renewable energy projects plus an expanded and extended credit for carbon capture, utilization and storage and direct air-capture projects.

Other tax provisions will benefit nuclear power plants and green hydrogen projects.

Tom Kuhn, president of the Edison Electric Institute, which represents electric utilities, said in a statement, "The robust clean energy tax package included in the IRA also will provide significant long-term benefits to electricity customers across America.

The American Petroleum Institute's reaction to the new law was largely negative. API President and CEO Mike Sommers said in a statement that though the measure "takes important steps toward new oil and gas leasing and investments in carbon capture and storage, it falls well short of addressing America's long-term energy needs and further discourages needed investment in oil and gas."

Among other sections, as AIA noted, one of the key recipients of the new law's buildings-related funding is the U.S. General Services Administration.

GSA said that it will receive about $3.375 billion from the Inflation Reduction Act, including $2.15 billion to fund the use of low-carbon materials, $975 million for sustainable technologies in federal buildings and $250 million to upgrade more facilities into high-performance green buildings.

GSA Administrator Robin Carnahan said in a statement that the legislation presents “a once-in-a-generation opportunity to move the federal government forward to a cleaner, greener future...”

In transportation, the legislation provides the Federal Highway Administration with nearly $4 billion—$950 million for states and $3 billion for localities—for grants for “carbon-reduction programs.”

It also allots to FHWA an additional $2.4 billion for neighborhood access and equity grants for such things as projects to reconnect neighborhoods cut off by highways and other transportation projects built in past years.

That augments funds for reconnecting neighborhoods included in last year's Infrastructure Investment and Jobs Act.

Construction unions and some major construction contractor groups split sharply over the legislation’s labor-related provisions, especially the requirement of using Davis-Bacon Act prevailing-wage standards and registered apprenticeship programs to qualify for clean-energy tax breaks.

North America’s Building Trades Unions hailed the provisions, but the Associated Builders and Contractors and Associated General Contractors of America strongly criticized the requirements.

The legislation also includes health-care provisions, including language aimed at reducing costs of prescription drugs and to extend subsidies for coverage under the Affordable Care Act, as well as the minimum 15% corporate tax on companies with earnings exceeding $1 billion and a 1% tax on stock repurchases by publicly traded companies .

Post a comment to this article

Report Abusive Comment